421a tax abatement meaning

The city of Cincinnati taxes homeowners only for the pre-improvement value. The 421-a Rent Stabilization Fact Sheet is intended to lay out basic information about 421-a and rent.

Understanding Rebny S New 421 A Tax Exemption Proposal Association For Neighborhood And Housing Development

Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

. Your property may qualify for a property tax exemption if your property value changed because you did construction on a multi-family residential building. The 421-a tax abatement was created in 1971 to encourage the development of underutilized or unused land by significantly reducing property taxes on newly developed land for a set period of time. While such tax NYC benefits apply to.

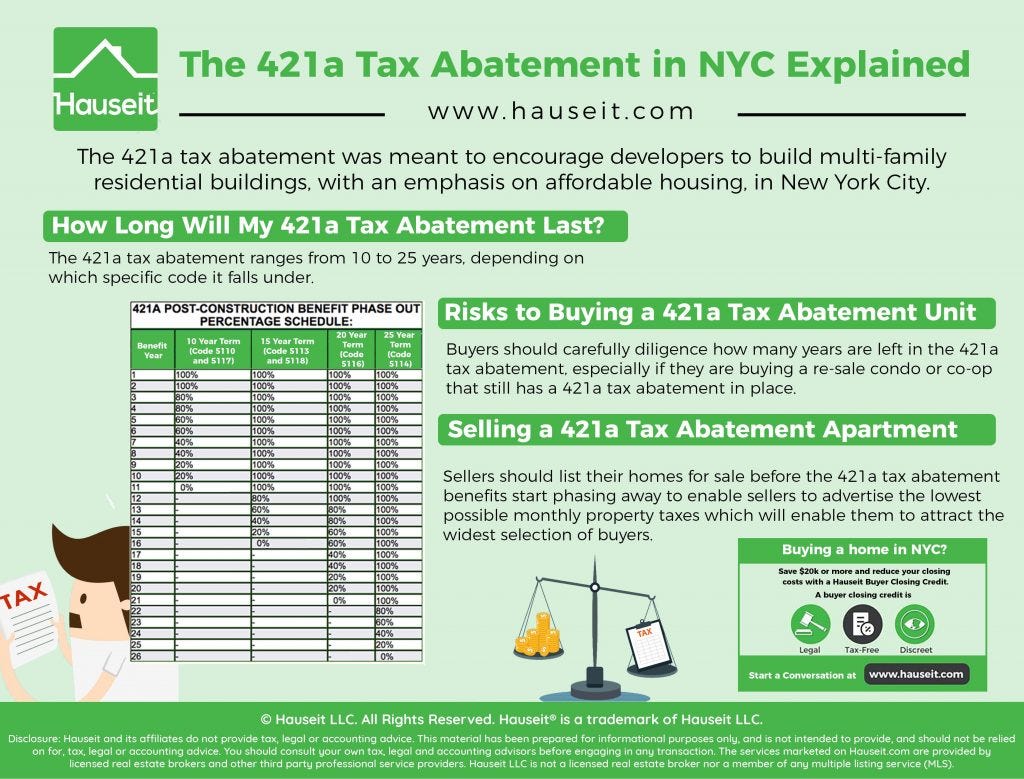

The schedules refer to how much of the 421a abatements benefits you can claim per year. When Is Florida Tax Free Weekend 2021. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

Ad No Money To Pay IRS Back Tax. Is your rental building receiving a 421. What is a 421a surcharge.

May 30 2022 622pm. This goes from 100 percent to fully taxable in increments of 20. The following terms whenever used or referred to in this section shall have the following meaning unless a different meaning clearly appears in the context.

During this period the property tax rate is frozen at the value of the property before the improvements. What does a 10 year tax abatement mean. For those who want to see New York.

Answer Simple Questions About Your Life And We Do The Rest. It was created in the 1970s to encourage development and originally didnt have any provisions for affordable housing. Tax relief 421a is a tax bill granted to real estate developers and focuses on affordable housing in densely populated areas of New York.

Homeowners can receive a 7000 exemption on their propertys assessed value for their main home if they reside in it on January 1. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. If your property appears in the list of 421a exemptions currently being processed for FY19-20 at the following link 421a exemption and you have a question please Contact Us.

They can gain the full exemption if they file before February 15 of that year. It costs the city 177 billion annually in lost tax revenue. The exemption also applies to buildings that add new residential units.

More than half or 56 of all the citys multifamily residential units created in the past eight years involved 421-a according to Housing Preservation and Development data analyzed by the Real Estate Board of New York. A 421a tax abatement lowers your property tax bill by applying credits against the total amount you owe. In 421-a buildings where the tax benefits are for 10 or more years and provided that a 22 lease rider is offered by the owner and signed by the tenant owners can collect annual 421-a surcharges equal to 22 of the rent charged at the beginning of the period of gradual diminution when real estate.

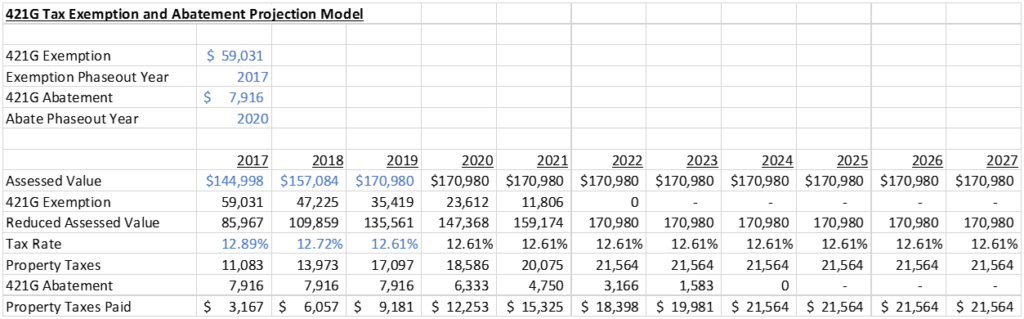

In the 1980s new provisions required developments that wanted the exemption to either contribute financially to the construction of affordable housing. Homebuyers can get a sense of what a cut really means by knowing when its due to expire. This table shows the terms and the schedules.

The end of the 421a housing-construction abatement means that the states property tax laws must be reformed. During the time period thousands of New Yorkers were moving upstate or to the suburbs and City officials feared a decline in residential development. If your rental building is receiving a 421-a property tax benefit your building andor apartment may be subject to rent stabilization and the rights and protections that come with it.

In order for a property to qualify for the current 421a tax exemption workers must have laid foundation footings at the site by June 15 2022. Learn Tax Consultant Certification - Best Tax Consulting Training - Free Tax Questions. Tax Abatement in Cincinnati.

While such NYC tax benefits apply to builders. You can have a 10-year 15-year 20-year or 25-year term. New construction on vacant land or a gut rehabilitation of an existing building is eligible for a property tax abatement lasting five to 10 years.

What is a 421a Tax Abatement In NYC. Although the current 421a expiration is nearly a year away it can take 18 to 24 months to design and construct a new building in New York City if not longer. Give this article.

What happens after 421a expires. For all term lengths the abatement percentage starts at 100 in benefit year 1 and phases out based on a set schedule over the 10-year 15-year 20-year or 25-year term. The exemption also applies to buildings that add new dwelling units.

The tiers matter the most since they tell you how long your abatement is good for. The subsidy known as 421a has been used in nearly every big residential project over its 51-year history. The 421a tax abatement is a program that lowers your property tax bill.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. How to Verify a 421a Tax Abatement. The amount of a 421a abatement is determined by the percentage of property tax that is abated in the benefit year.

You might be interested. The second-highest tax break an abatement for coops and condos cost 655 million last year. Tax Abatement in California.

5 Nyc Condos For Sale In Buildings With A 421a Tax Abatement Still In Place

Tax Abatement Nyc Guide 421a J 51 And More

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421a Tax Abatement In Nyc Youtube

Everything You Need To Know About Nyc S 421 A Tax Program By Hauseit Medium

How Much Is The Coop Condo Tax Abatement In Nyc

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatement What It Is And How You Can Benefit From It

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Tax Abatements Guide 421a J 51 And More Makingnyc Home

What Is A 421a Tax Abatement In Nyc Streeteasy

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Real Estate Taxes Blooming Sky

What Tax Benefits For Investment Properties In Nyc Nestapple